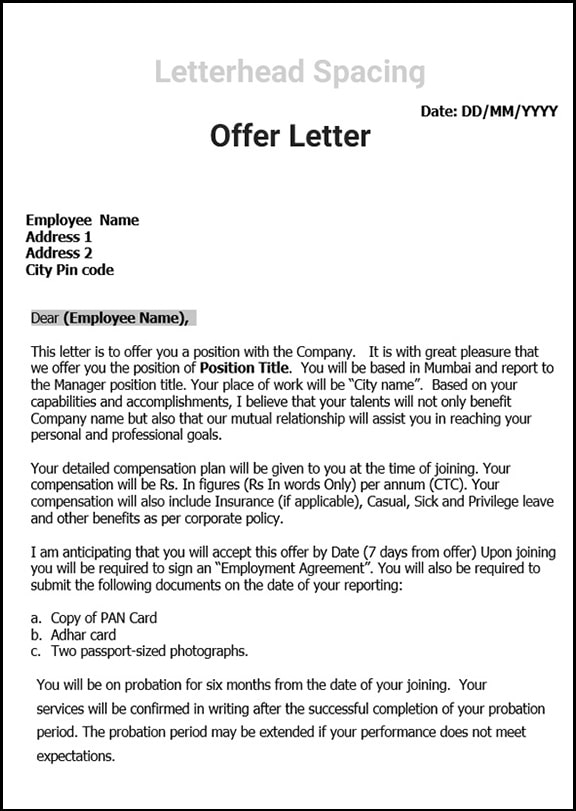

Minimum Wages in Maharashtra: Legal Compensation Structure

What is the Minimum Wages Act 1948?

The Minimum Wages Act of 1948 is a labor law in India that aims to ensure fair remuneration for workers across various industries and sectors. It sets the minimum wages n Maharashtra employers must pay their employees to prevent exploitation and provide a decent standard of living. Under this act, the government establishes and revises minimum wage rates for different employment categories, considering the nature of work, skill level required, and cost of living. As a result, the minimum wages can vary based on geographical regions and job classifications.

Furthermore, the act provides provisions for the constitution of Advisory Boards at the national, state, and industry levels to advise the government on wage-related matters and to facilitate social dialogue between employers and employees.

Objectives of the Minimum Wages in Maharashtra

The purposes of the Minimum Wages Act in India are as follows:

1. Ensuring Fair Wages

The act aims to establish minimum wage rates to ensure that workers receive fair remuneration for their labor, considering factors such as the nature of work, skill level required, and cost of living.

2. Preventing Exploitation

It seeks to prevent the exploitation of workers by setting a floor wage below which employers cannot pay their employees. To clarify, Let us consider this as an example, a t-shirt is being sold for 100 rupees in the market, but a laborer working hard day and night to make that t-shirt is not even getting paid 2 Rs by their owners of mills.

3. Promoting Social Justice

The act aims to promote social justice by providing a mechanism to uplift the economic conditions of workers, particularly those in vulnerable and unorganized sectors.

4. Protecting Workers’ Rights

The act protects workers by establishing a legal framework for minimum wages. It empowers workers to demand and receive fair wages for their work, enhancing their overall well-being and dignity.

Definition of Unskilled, Semi-skilled, Skilled & Highly Skilled Workers

1. Unskilled

An unskilled worker performs simple duties without requiring independent judgment or previous experience, although familiarity with the job environment may be necessary. Their work involves physical exertion and handling various articles or goods.

2. Semi-Skilled

A semi-skilled worker carries out routine tasks where judgment or skill is not the primary requirement. Their responsibilities are limited to a narrow job scope, and others make critical decisions.

3. Skilled

Skilled employee demonstrates efficiency, independent judgment, and roles & responsibility in performing their duties. They possess comprehensive knowledge of the trade, craft, or industry in which they work.

4. Highly Skilled

A highly skilled worker efficiently performs tasks and supervises skilled employees.

To ensure fair payment and prevent exploitation, laborers must understand the category or classification under which their job falls. This categorization helps determine the appropriate wage structure based on skill level, job complexity, experience, and responsibility, ensuring the laborer adequately compensates for their specific position.

Minimum Rates of Wages

There are two approaches to addressing and modifying minimum wages:

Appointment of Committee

- The committee method involves the two forms of committees and subcommittees by the government. These groups investigate and give recommendations on how to determine the minimum wage based on the current inflation rate in the state.

- The government shares its ideas and plans for minimum wage changes by publishing them in a particular official document called the Official Gazette. Now the laborers have to understand under which category they fall and if their employers are providing them with what they are designated for. Establishment of Balanced Advisory Committees and Boards: Legislation is enacted to facilitate the appointment of Advisory Committees and Advisory Boards, ensuring equal representation from employers and workers.

Establishment of Balanced Advisory Committees and Boards: Legislation is enacted to facilitate the appointment of Advisory Committees and Advisory Boards, ensuring equal representation from employers and workers.

Responsibility for Payment of Wages

The obligation to ensure employees are paid more than the designated wages is the responsibility of every employer. It is the employer’s job to structure and manage this process effectively.

The responsibility for providing wages is determined as follows:

- For individuals employed in non-contractual positions in factories, the manager of the factory appointed under section 7 of the Factories Act is responsible for disbursing wages.

- In the case of industrial or other institutions, the person who holds the position of supervision and control over the establishment on behalf of the employer is responsible for wage payment.

- For individuals employed in railways, excluding those in factories, the railway administration and an authorized representative appointed by the employer for the specific local area are responsible for remunerating the employees.

Time of Payment of Wages

- The time frame for wage payment varies depending on the nature of the workplace:

For railways, factories, or industrial/other establishments with less than one thousand employees, wages must be paid to the employees before the seventh day of the following month.

- In the case of other railways, factories, or industrial/other establishments, wages must be paid before the tenth day of the subsequent month. However, there is also the provision to make payments after the usual payment date but within a reasonable timeframe after the designated payment day.

Method of Payment

The method of wage payment is as follows: Wages must be paid in the form of current coins, currency notes, or a combination of both. Additionally, employers can pay wages through cheques or by crediting the amount directly into the employee’s bank account, provided they have received written authorization for such a mode of payment. Regarding deductions, Section 7(1) states that any payment made by an employed person to the employer or the employer’s agent will be considered a deduction from the wages under the provisions of this act.

Penalties

Imposing fines or penalties on any workers for their employer’s omissions can only be carried out if prior approval is from the State Government or the designated authority specified in the notice under subsection.

Before imposing fines, the worker must be given reasons for the penalty and be subjected to a prescribed procedure specifically outlined for the imposition of fines.

Furthermore, the fines imposed on any employed person during a wage period should not exceed 3% of the wages payable to them for that specific period. It is important to note that fines cannot be imposed on any employed person below the age of fifteen.

Calculated Minimum Wages in Maharashtra 2024

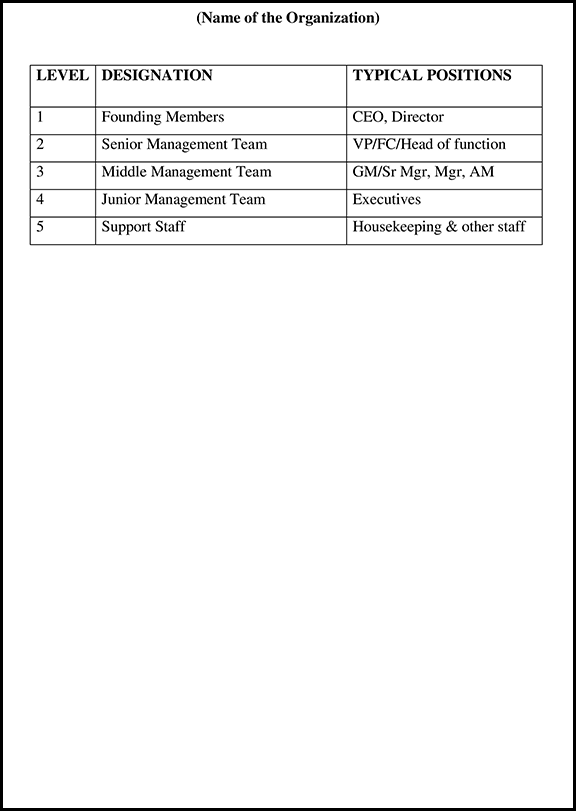

| Class of Employment | Zone | Basic Per Month | HRA Per Month | VDA Per Month | Total Per Day | Total Per Month |

| Unskilled | Zone I | 10021 | 623.25 | 2444 | 479.42 | 12465 |

| Unskilled | Zone II | 9425 | 593.45 | 2444 | 456.5 | 11869 |

| Unskilled | Zone III | 8828 | 563.6 | 2444 | 433.54 | 11272 |

| Semi-skilled | Zone I | 10856 | 665 | 2444 | 511.54 | 13300 |

| Semi-skilled | Zone II | 10260 | 635.2 | 2444 | 488.62 | 12704 |

| Semi-skilled | Zone III | 9664 | 605.4 | 2444 | 465.69 | 12108 |

| Skilled | Zone I | 11632 | 703.8 | 2444 | 541.38 | 14076 |

| Skilled | Zone II | 11036 | 674 | 2444 | 518.46 | 13480 |

| Skilled | Zone III | 10440 | 644.2 | 2444 | 495.54 | 12884 |

| Security Guard/Lady Security Guard – Security Services | Mumbai/Thane | 12082 | 2905 | 2444 | 558.69 | 14526 |

| Head Guard – Security Services | Mumbai/Thane | 12357 | 2960 | 2444 | 569.27 | 14801 |

| Security Supervisor – Security Services | Mumbai/Thane | 13057 | 3100 | 2444 | 596.19 | 15501 |

| Assistant Security Officer – Security Services | Mumbai/Thane | 13282 | 3145 | 2444 | 604.85 | 15726 |

| Security Officer – Security Services | Mumbai/Thane | 13732 | 3235 | 2444 | 622.15 | 16176 |

| Chief Security Officer – Security Services | Mumbai/Thane | 14182 | 3325 | 2444 | 639.46 | 16626 |

| Security Guard/Lady Security Guard – Security Services | Pune | 7400 | 2090.4 | 6536 | 536 | 13936 |

| Head Guard – Security Services | Pune | 7500 | 2105.4 | 6536 | 539.85 | 14036 |

| Security Supervisor – Security Services | Pune | 8000 | 2180.4 | 6536 | 559.08 | 14536 |

| Assistant Security Officer – Security Services | Pune | 8500 | 2255.4 | 6536 | 578.31 | 15036 |

| Security Officer – Security Services | Pune | 9000 | 2330.4 | 6536 | 597.54 | 15536 |

| Chief Security Officer – Security Services | Pune | 9400 | 2390.4 | 6536 | 612.92 | 15936 |

Join a Community of 1,00,000+ HR Professionals