How Payroll Software Works: A Complete Guid for HR

Payroll! PAYROLL – Do you feel frustrated, & stressed hearing this word? If you are a beginner, it might haunt you as being a complex & monotonous task.

But, unfortunately, business owners have no escape from it!!

Do you know multiple businesses are penalized billions of dollars by the IRS for committing payroll-related errors? Payroll is undoubtedly one of the significant expenses for any company. If you don’t handle it correctly, it leads to various human-based errors like record miscalculations, inaccurate tax payments, late payments, underpayment, or paying over salaries to employees. Further to this, employees suffer morally, and organizations suffer financially.

So, what’s the solution for the never-ending payroll struggles? How do we deal with it?

The solution is very straightforward & simple – ‘Automated Payroll Software.’

Due to reduced human intervention, the scope of errors minimizes significantly as the Software handles everything. According to SHRM, 59% of employees feel salary is the most motivating & fulfilling element of their job. Once they started receiving their pay correctly & on time with payroll software, their motivation enhanced.

In this blog, we will explore

- What is Payroll Software

- How Payroll Software Works.

- Best Payroll software in India

- Key Features of Software

What is Payroll Software?

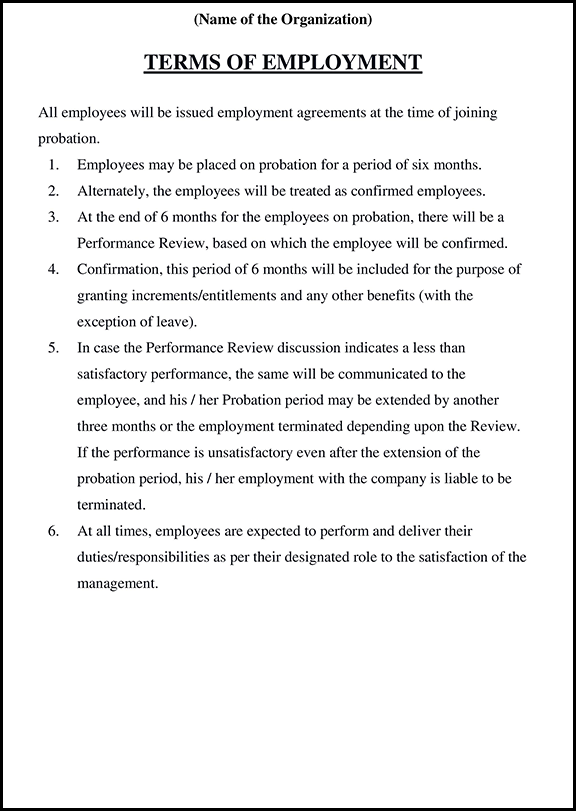

Payroll software is a solution, either on-premises or cloud-based, designed to handle and automate employee payments. It effectively manages payroll processes, ensuring compliance with tax laws and financial regulations while minimizing costs. This robust and integrated software is suitable for organizations of any size, providing efficiency and accuracy in payroll management.

How Does Payroll Software Work?

Payroll software enables automating calculating and managing employee salaries, wages, and benefits. It simplifies the complex and time-consuming task of processing payroll by automating tasks such as tracking employee time and attendance, calculating deductions for taxes and benefits, and generating paychecks and other reports.

But how Payroll Software works and help the employees?

1. Employees can edit, access & modify their sensitive personal data, payment preferences, and relevant information.

2. It speeds up the entire process where employees get accurate and on-time compensation through direct deposit, payment card, check, etc.

Therefore, as a result, work disruptions get minimized by a significant percentage.

Do you think payroll software improves the way employers work today?

1. The payroll system is a big blessing for HR employers. These payroll systems are generally flexible, easy to configure, and reliable alternatives for supporting employee payments automation.

2. With the payroll system, employers smoothly manage the checklists, payroll flows, complex rules & obedience to tax laws and relevant regulations. It saves considerable time and effort for Human resources teams.

1. First, You Need Payroll Software

In the first step, employers must choose the best payroll software for their organization to manage the entire payroll process. After doing in-depth research, they will learn which payroll software most precisely meets their requirements and where they want to invest.

Here is the list of best Payroll software in India:

A. Keka

Keka is an HRMS Software company meant for every industry. They’re committed to providing the best industry-based HCM software for supporting companies in managing their talent effortlessly. Keka’s Payroll & Expenses online software redefines the entire payroll process by saving considerable time.

B. Zimyo

Zimyo is the number 1 employee experience platform that handles everything from Onboarding to Offboarding employees. The firm is well known for Robust HRMS for employees & employers, with 1.5 B+ processed payroll records to date. Zimyo’s payroll software has helped employees improve work efficiency by 76% & minimize human errors & payroll costs by 80%.

C. 247 HRMS

Their 247 HRMS payroll software has been designed to ensure paperwork reduction, data security, time management, and a streamlined payroll process. The 247 HRMS toolkit provides various features to their clients, like employee self-service, income tax management, payroll management, attendance management, etc.

D. Zoho

Zoho Payroll allows you to automate pay stub generation, payroll calculation, and taxes with timely employee payment. Such online payroll software is designed to comply with federal and state taxes.

E. GreytHR

By automating the HR processes, the greytHR payroll software helps you flip all the payroll computation errors. They provide you with a seven-day free trial to assess the suitability of the payroll software to your organizational needs. With the help of this Software, you get on-time disbursement of salaries, saving you from the chaos & hassles at the end of every month.

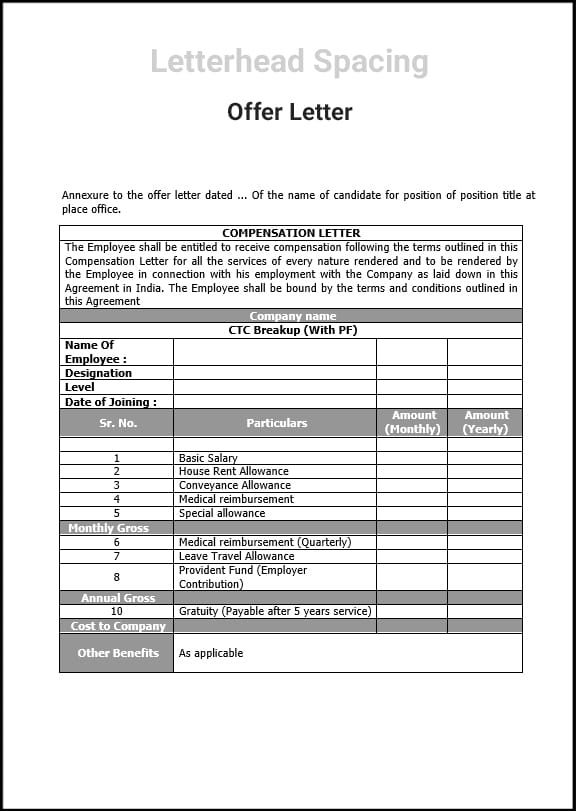

2. Employee Data

The basic details of employees are collected when they join the organization. These basic details include a pan card number, Aadhar card number, bank account details, phone number, address, etc. It ensures that all the information of employees stays correctly stored in the system to retrieve them whenever required. Such collection of data helps in on-time payroll processing.

Once you have data of employees in front of you, you need to validate them, & make sure that it complies with the approval models & payroll policies of your companies. Take care of adding only the active employees for the payroll process and ensure that none of your ex-employees are added to the list, else salary will get disbursed in their accounts too.

3. Payroll Calculation

The payroll expert enters all the information from the employees into the ‘payroll processing system’ to further calculate payroll. As a result, we get net payments that are specific & vary for every employee after accommodating taxes and other deductions. It increases the chances of human errors as every calculation is performed on spreadsheets.

More than 20% of companies need help with problems when the payroll expert leaves the organization as they have no immediate backup planned to handle the payroll operations.

4. Payment/Salary

Much back-and-forth work is required while releasing the salary to employees. Companies have to look after their accounts to ensure they have enough funds to be given to each employee as their salary.

Furthermore, they must coordinate with the concerned bank to issue a salary bank advice statement. Then they order the bank to disburse wages for employees. The whole activity is chaotic, time-eating & frustrating for the employers and employees. The automated payroll software has a feature of one-click salary disbursement. Such a feature takes away the headache of indulging in time-consuming activities.

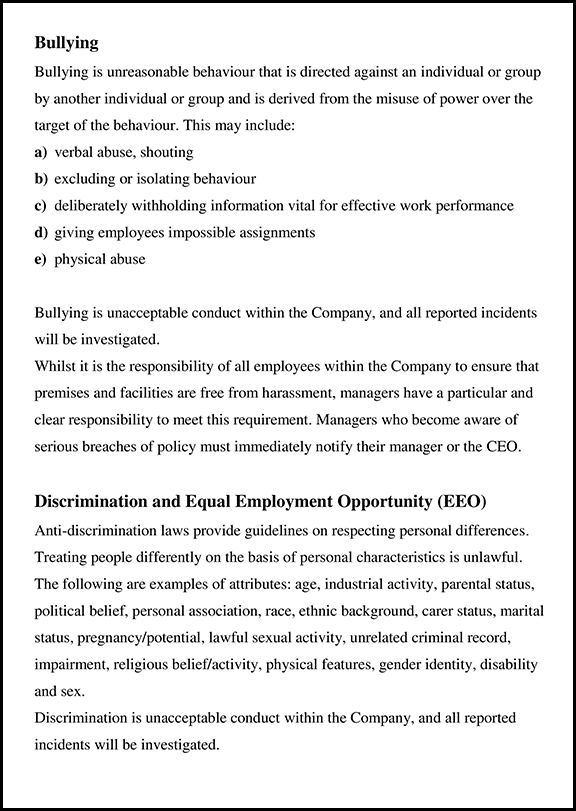

5. Compliance

Every type of statutory computation, such as Professional Tax (PT), Employee State Insurance (ESI), Tax Deduction at Source (TDS), Labour Welfare Fund (LWF), Establishments, Provident Fund (PF), Shops, etc., are mandatory to be considered by all Indian companies. Payroll software works well in keeping up with the sudden changes in payroll laws & accommodating everything according to it instantly.

However, almost 40% of the companies reported coming under the legal offense of punishment for non-compliance with the regulations. It happened due to ignorance, carelessness, and disregarding current legal updates. With the payroll compliance software, you need not worry about all such new updates, as the system does that for you.

6. Integration

The payroll software easily integrates with HR or accounting software. The integrated HR and accounts Payroll software gives relevant & necessary information to function payroll automatically without human intervention. The back & forth hassle of the payroll department handling the reimbursement bills, leave and attendance records, etc., gets reduced significantly.

In addition to this, the record tallying process consumes considerable time. Such precious time can be saved & invested somewhere else using automated payroll software. It tracks the relevant data, manages accounts, and keeps them organized. The account payroll software supports you by automating everything so you don’t have to juggle the numbers in spreadsheets whenever pay is released.

7. Data Security

Data security is integral to the payroll process. It is so because employees are asked to submit their sensitive data at the time of joining the company through official documents. If these data are stored in a spreadsheet, then the chances of getting misused with one password are higher. These documents comprise their pan number, Aadhar card number, bank details, rental agreement papers, etc.

If third parties compromise the security of employee data, there is a higher chance of fraudulent activities occurring. As a result, it would severely affect the organization’s overall reputation, leading to legal cases and financial losses.

The automated payroll software stores everything safely on the platform, and only authorized people can access it.

8. Salary Slip (Payslip) via SMS or Email

The company must distribute tax computation sheets, pay slips, or salary slips to employees. Imagine how time-consuming it would be to circulate pay slips individually to every employee.

Moreover, the risk of errors increases by three times in such practices. The more errors humans commit, the more the chances of time spent rectifying them.

It not only deteriorates reputation but also brings a thin wall between employees & employers, leading to a lack of motivation & high-end loss of productivity. This step is monotonous and an extra burden on a human resource team, leading to time wastage and curtailing productivity.

9. Time, Attendance, and Leave Integration

The automated payroll software helps in the leave & attendance integration. It does so via APIs, web portals, card/fob, or biometric devices.

Attendance, leave & time integration with the payroll software helps to transfer the attendance data record stored in an external system to the payroll software system. Through this integration, companies save administration time, money, and unwanted human errors.

As a result, they get accurate attendance calculations, staff working hours records, & a well-structured payroll process.

Key Features of Payroll Software

- Security Features

- Payroll Reports

- Cloud Security

- Employee Self-Service Portal

- Statutory Compliance

- Full and Final Settlements

- Online Salary Payments

- Accurate Tax Filings

- Spreadsheets Data Import

- Customizable Salary Components

- User Roles and Permissions

- Quick payroll processing

- Leave and Attendance Handling

- Automatic Payroll and Payslip Distribution

Conclusion

Payroll software is a powerful tool that manages & simplifies HR operations and payroll processes. However, if you are more interested in a payroll management solution, you can request an HR software demo. This demo will provide a firsthand look. And allow you to ask a question.